Introduction-

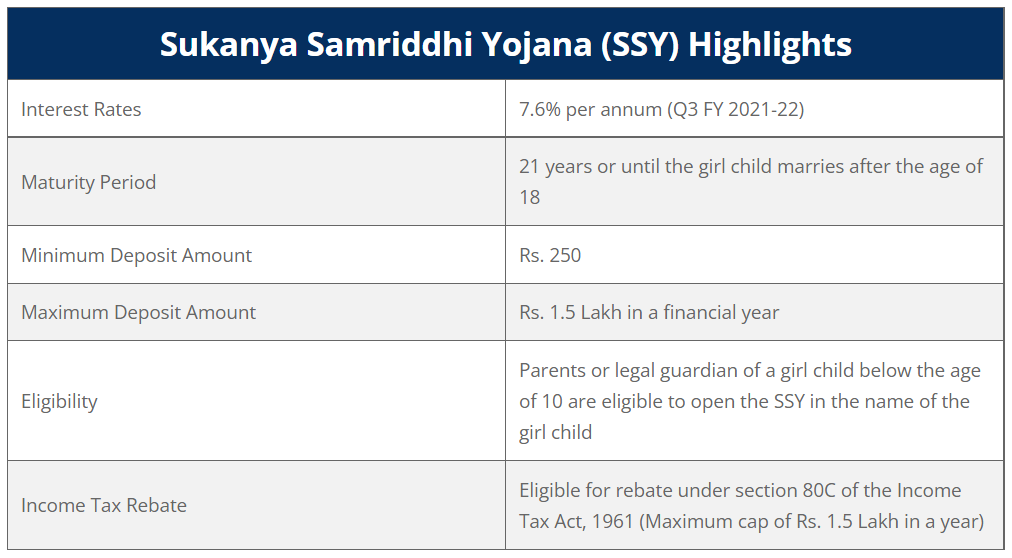

Sukanya Samriddhi Yojana is a Government that launched the saving scheme. It was specially launched for the girl children. It is the most beneficial saving scheme with the highest rate of interest at present. At present, the interest rate is 7.6% annum which is revised by the government quarterly. It secures a girl’s life and helps her family to save the amount for her higher education and marriage. She is eligible to operate her account on her will after the age of 18 years.

When Sukanya Samriddhi Yojana was launched?

Sukanya Smriddhi Yojana was launched by our honorable Prime Minister Mr.Narendra Modi on 22 January 2015. It works as the part of “Beti Bachao Beti Padhao” Campaign. At initial stages, the interest rate was 9.1% later on which was changed to 9.2% for 2015-2016.

Table Showing Interest Rate Revisions Are-

Features of Sukanya Samriddhi Yojana-

- Closure before maturity period is only allowed in the following cases-

- Medical treatment of girl against some deadly disease

- Death of the parent/guardians who deposits the amount in the account

- If the depositor is unable to deposit Rs.250 even in a year then the account is tagged as the Default account. The default account will earn the interest applicable in the scheme.

- The girl is eligible to operate her account after the age of 18 years after submitting all the required documents to the post office and bank from where the account has been opened.

Benefits of Sukanya Samriddhi Yojana-

- If a girl child is born before twin girls then the account for the first girl child can be opened. In this way, one can open more than 2 accounts under SSY.

- Tax deduction benefits of up to Rs.1.5 lakh under section 80C of Income Tax Act.

- The highest fixed rate of return i.e. 7.6% per annum which is comparatively higher than other small saving schemes.

- Huge benefits in case of Long term investments.

- Easily transferable from one post office or designated bank to another bank or post office.

Eligibility Criteria Of Sukanya Samriddhi Yojana-

One can open an account under Sukanya Samriddhi Yojana on the basis of following parameters-

- The age of girls should be less than 10 years.

- The girl should be a citizen of India.

- Two girl children in a single-family are eligible for the Sukanya Samriddhi Yojana account.

- Multiple SSY accounts cannot be opened for a single girl child

How To Open Sukanya Samriddhi Yojana Account?

- One who is looking forward to opening an account under SSY can visit the nearer post office or some of the authorized commercial banks. You can also download the Sukanya Samriddhi Yojana Application Form from RBI official website.

- The girl child should meet all the eligibility criteria in order to open the account.

- Deposit in the account can be made for the time period of 15 years after which one can close the account.

- The girl after the age of 18 years is eligible for the partial withdrawal and after the age of 21 years, she can close the account on her will.

Sukanya Samriddhi Yojana Tax Benefits

The scheme got very popular and widely acceptable due to its tax benefits. It provides the maximum tax benefit of Rs.1.5 lakh under section 80C of the Income Tax Act. The interest accrued and maturity is exempted from the tax. One can easily calculate the maturity amount that the girl is getting from the SSY account at the end of the maturity period. The amount may vary on the basis of your deposits and interest rates per financial year. It will let you know how much you can save for your daughter’s education and marriage with the help of Sukanya Samriddhi Yojana.

Terms And Conditions Of Sukanya Samriddhi Yojana-

- Girl’s age should not exceed 10 years.

- A minimum deposit of Rs.250 is required at the initial stage for opening the SUKANYA SAMRIDDHI YOJANA account.

- The maximum deposit limit account under SSY is Rs.1,50,000.

- Withdrawal of 50% amount is allowed after the girl’s age of 18 years for higher studies.

- Closure of account is allowed after 15 years of the time period from opening. If the girl is 18 and married then also normal closure of the account is allowed.

- A minimum deposit of Rs.250 in a year (initially it was Rs.1000) is restricted otherwise fine of Rs.50 will be charged.

How To Calculate Total Amount With Sukanya Samriddhi Yojana Calculator?

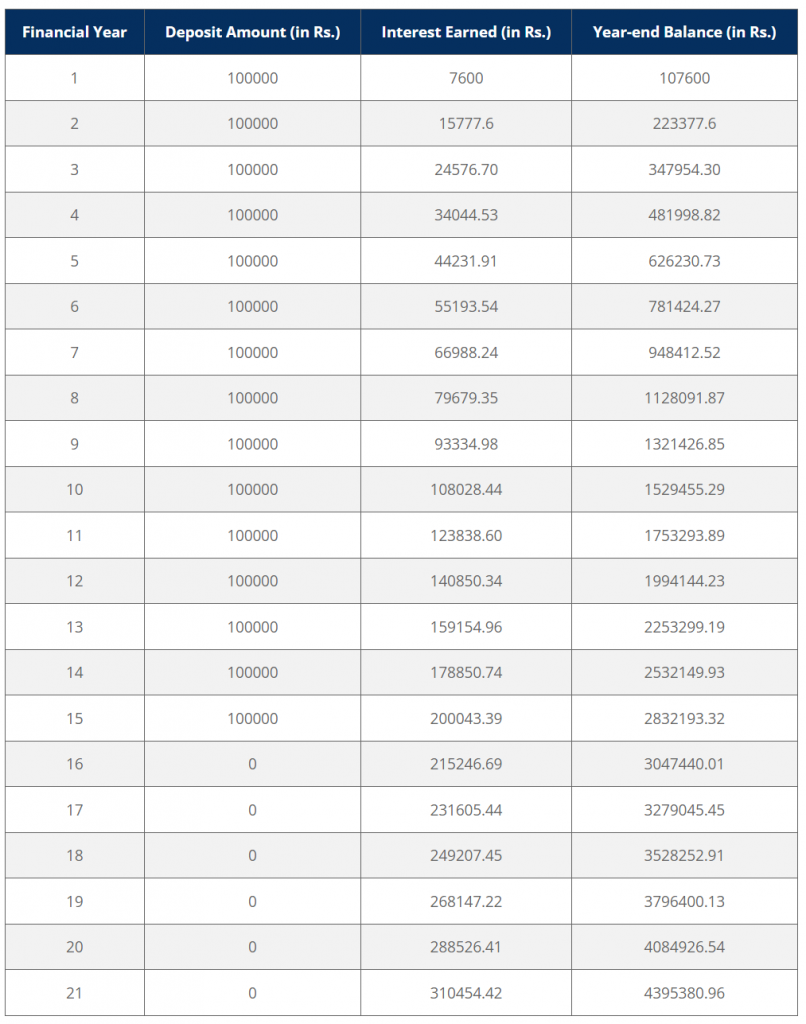

As per the rules of Sukanya Samriddhi Yojana, the deposit must be made till 15 years from the date of opening the account. The limit of deposit was in a financial year was Rs.1000 at the initial stage but now it has reduced to Rs.250 which means a person has to deposit a minimum amount of Rs.250 in a financial year.

The maturity period of Sukanya Samriddhi Yojana is 21 years but the period for depositing amount is 15 years. From the time period of 15th till 20th year, no deposits are required to be made in the account. You will earn deposits made in the earlier years. The interest that will be accrued will be on the basis of past deposits.

Sukanya Samriddhi Yojana Account Transfer

One of the major benefits of the Sukanya Samriddhi Yojana account is that it is easily transferable from one part of India to another part. You can only transfer this account from one post office of India to another bank or post office only for the benefit of the girl child.

How to Transfer?

To initiate the transfer process for the account is extremely easy. You just need to fill out the Transfer Request Form from the post office where the account is currently opened.

Or if you have opened the account from the commercial bank then also the online and offline forms are available for the transfer of the account.

Latest News & Updates About Sukanya Samriddhi Yojana –

As the whole country is suffering from Coronavirus pandemic and has been facing a major financial crisis some relaxation norms have been announced by the Government.

As per the latest guidelines from the postal department, the account on the name girl child can be opened who attained the age of 10 years in the lockdown i.e. from 25 March 2020 to 30 June 2020. This is because the parents could not open the account due to lockdown.

The revised interest rate in the year is 7.6% which is highest among all the small saving schemes.