Multibagger stocks refer to stocks that offer returns several times to its costs. The undervalued stocks with strong fundamentals prove to be a great investment option. These stock companies have a scalable business within short time span.

Stock that gets double to its amount is known as two-baggers. The stocks that get 10 times its amount are known as 10-Bagger. Stocks with prices risen multiple times from its initial investment value are known as multibagger stocks.

History of Multibagger Stocks

Multibagger stocks were introduced by Peter Lynch in his book named as “One Up on Wall Street”. These shares are issued by the companies having strong growth potential with strong management and production techniques. With company’s excellent development and research skills, multibagger shares generate high demand in the market.

What type of company can generate Multibagger Stocks in India?

Multibagger stocks for 2021 with a manifold of getting returns on investments. Investors can only expect returns from investments if the company possess the given characteristics-

▶️ Excellent Research & Development Skills

The growth of any company is directly associated with the volume of sales that it generates in the market. Sales can only be acquired with the delivery of quality products to the consumer for customer satisfaction. So, for ensuring the success of the company’s multibagger stocks, a company must go through considerable investment & time in research and development of the product before enlisting in securities in the stock exchange.

Startup ventures can introduce products with likely to have more customer volume and no substitutes are likely to generate high market demand for the product. The Paid-up capital of such startups can be increased at a tremendous rate with Multibagger stocks.

▶️ Accelerated Growth

The performance of the Multibagger stocks depends upon the company’s performance that is issuing it. Businesses with high profit and less debt liability are top contenders. Multibagger stocks for 2021 have high earnings per share ultimately increasing your investment amount. The following companies also have a low debt to equity ratios, indicating strong financial management skills.

Article- How to Open Free Demat Account with Upstox? Step-by-Step Guide with screenshots

Investing in Stock is super simple now!!

▶️ Management Skills

Companies having experienced and skills managers issue multibagger stock in order to maintain the flow of the production chain. Managers also ensure the coordination between the production and supply chain. The company also appoints an experienced set of analysts to identify the pricing level of the products and revenue maximization.

Why it is beneficial to invest in Multibagger Stocks India?

Multibagger stock in India is known to increase your wealth with the tremendous increase in investments.

Let us give idea of how tremendous growth you can expect from multibagger stocks,

Suppose you invest Rs.200 from your pocket money in multibagger stocks with the realised profit of 10 times the amount of investment you amount has now became Rs.2000 which ten times the original amount of investment resulting in 10-bagger stocks.

However, this amount must be kept in for a minimum period of time to ensure capital gains through funds turnover and final products sold in the market. These funds obtained from the listing of shares can be used in both research, development, and manufacturing of the product.

What is the risk involved in investing Multibagger Stocks?

▶️ Market Downturn

Multibagger stocks in India are purchased with the sole purpose of wealth creation in India but on the other hand, an individual also has to face loss in case he/she got encountered with a market downturn.

▶️ Panic Buying/Selling of Shares

Many investors get into the trap of high returns from Multibagger shares and invest a heavy amounts on the purchase of the same. But the market conditions are really uncertain, there might be regular price fluctuations in the price of the shares results in heavy loss to an individual. This also arise the situation of panic buying/selling of the shares.

▶️ Crashing of Expectations

In some cases, the product seems to be very profitable and valuable to the customer but in long term, it might prove to be a bad investment option. The investor’s expectations might get hurt with the low performance of the shares in the market, therefore, results in massive losses to the individual.

All in all, it takes careful analysis and study of the company’s financial statement before investing in Multibagger Stocks of the company.

Jump Into Stock Market with Alternative Investment Options-

Investors willing in stock market investments can do so by several means for adding value to their portfolio-

▶️ Debt Funds

Debt funds are comprised through the securities issued by the company. For revenue generated debt financing is a good option thereby reducing the risks.

Investors who want to lock in their money in secure investment options go for investment in debt funds. Portfolio managers of debt funds include different government securities & liquid money market instruments to ensure maximum returns at minimum associated risks.

▶️ Hybrid Funds

Hybrid funds aim to achieve a balance between risk and return. Both equity and debt securities are involved in the portfolio of such funds. High profits can be generated through the presence of equity stocks in the corpus while market fluctuation can also result in minimal earnings through debt-oriented securities present.

▶️ Large Cap Funds

Multibagger shares in India are issues by startups that increase the involvement of the risk in investment. On the other hand, if we talk about large-cap funds, investment in equity securities of the companies having capital of more than Rs.20,000 crore.

However, this obviously means that the company has a renowned reputation, financial strength which ultimately reduces the chances of generated low returns.

Large-cap companies ensure capital preservation of investors in any uncertain market downturn due to the availability of adequate financial resources.

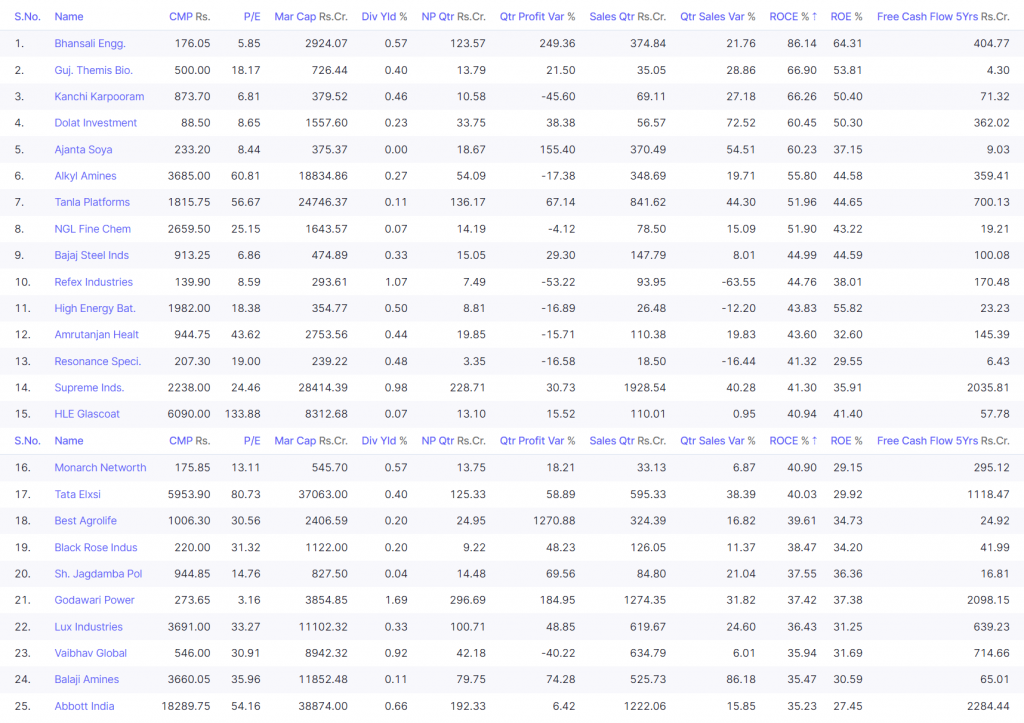

Multibagger Stocks for 2022

Source-Screener

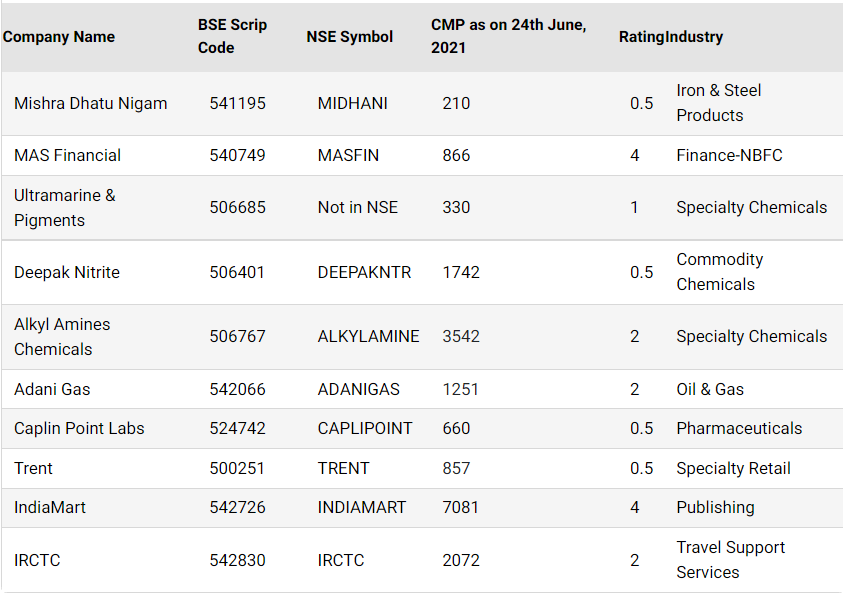

Best Multibagger Stocks to Invest In India

Source- Samco

Final Words

Multibagger Stocks in India are suitable for those investors who have the sole purpose of wealth creation by a substantial amount. These are high chances of massive profit earning as the incremental value of Multibagger stocks is multiple times higher than the actual price of share acquisition. At the same time, investors must be prepared for the risk associated with such kinds of multibagger shares.

Read More: 5 Best Trading Platforms In India