ICICI Pru Assured Savings Insurance Plan is a traditional non-participating non linked endowment life insurance plan. It helps to secure your dreams of the future by filling up the emergencies and risks of the future. One can save their money and expect for fulfilling long-term goals like education of your children, marriage of your children, comfortable and happy life after retirement, and so on. Under this best savings plan, you get two major benefits i.e. wealth creation plus tax benefits. You can also make premium payments according to your comfort. Also, ICICI Pru Assured Savings Insurance Plan provides your life insurance cover of your family in case of your unfortunate demise. Talking about tax benefits, you can avail various benefits on premium paid and received according to the present tax laws.

ICICI Prudential Assured Savings Insurance Plan Eligibility Criteria

| Minimum Entry Age | 6-8 Years |

| Maximum Entry Age | 60 Years |

| Maturity Age Lies Between | 18 Years – 72 Years |

Policy Terms for the ICICI Prudential Assured Savings Insurance Plan:

| Premium Payment Term | Policy Term |

| 7 years | 10 years 12 years |

| 10 years | 12 years |

| Premium In Rs | 12000-18000 |

ICICI Pru Assured Savings Insurance Plan Premium Payments:

| Minimum Premium | 7 year premium payment term: Policy term of 10 years – Rs.18,000 Policy term of 12 years – Rs.18,000 10 year premium payment term: Policy term of 12 years – Rs.18,000 |

| Premium payment | The premiums can be paid for 7 years or 10 years.

The policy lasts for 10 or 12 years ( if 7 pay plan) but 12 years for 10 payment plan. The minimum premium payable is Rs.18,000 in the of seven payments and Rs. 12,000 for 10 pay option. ICICI Pru Guaranteed Savings Insurance Plan of 10 years, you can start the plan from the age of 8 but should not exceed 60 years. For the 10 pay option, you can start the plan from the age of 6 but should not exceed 60 years. For a policy term of 12 years, you can start the plan from the age of 6 but should not exceed 60 years. The minimum policy maturity age is 18 years and the maximum cannot exceed 72 years in both cases. |

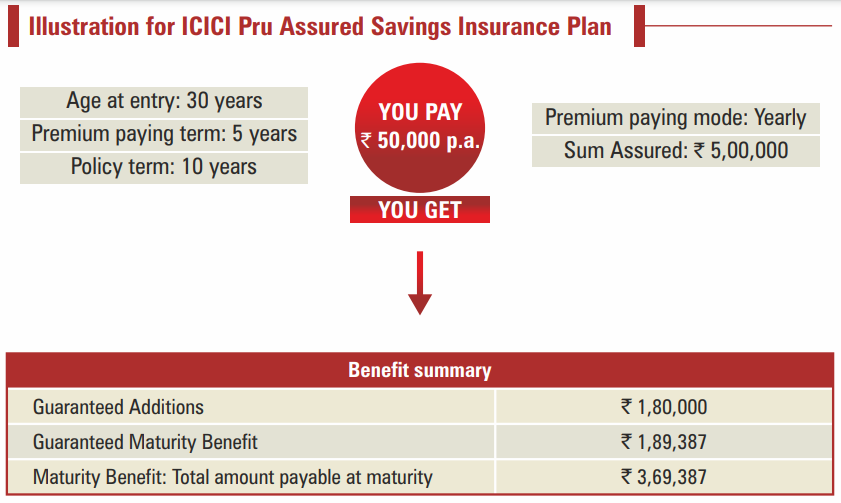

ICICI Prudential Assured Savings Insurance Plan Calculator

Features Of ICICI PRU Assured Savings Insurance Plan

| Plan Type | Traditional non-participating non-linked endowment life insurance plan. |

| Premium Payment options | Yearly, Half – Yearly, Quarterly, Monthly |

| Free look period | Free Look period is 15 days from the date you received the policy. If the policy has been purchased through distance marketing, then the free look period is 30 days. |

| Loans | Up to 80% of the surrender value can be availed as loan amount. |

| Revival | A policy that has been discontinued can be revived within 2 years from the due date of the first unpaid premium. |

| Surrender benefit | If your policy term is 10 years, you will acquire surrender value after 3 full year’s payment. If your premium payment term is 7 years, you will acquire surrender value after 2 full year’s payment. On surrender, you will get Guaranteed Surrender Value plus the value of accrued Guaranteed Additions and Special Surrender Value. |

| Tax Benefits | As per Section 80C and 10(10D) of the Income Tax Act |

| Riders | No Riders available under this plan |

| Guaranteed Additions | 9% Or 10% Every Year |

| Guaranteed Maturity Benefit | The lump-sum amount at end of the policy term |

Benefits Of ICICI PRU Assured Savings Insurance Plan

Guaranteed Additions

These are paid on the maturity of the policy. It gets added to your policy at the end of every policy year when all the premiums have been paid. It is also accepted for death benefits as well. The Guaranteed addition rates are:

For 10 years term- 9%

For 12 years term- 10%

Guaranteed Benefits On The Maturity Of The Policy

Guaranteed Maturity benefits depend upon the premium, payment term, policy term, gender and age of the person.

Maturity Benefits

These Maturity benefits are provided to the policyholder at the end of the policy term when all the premiums are paid as well. Maturity Benefit is

Accrued guaranteed additions + Guaranteed maturity benefits

Death Benefits

If the unfortunate demise of the policyholder happens then death benefits are offered to the dependent of the policyholder. The death benefit is either the sum assured plus the accrued guaranteed additions, minimum death benefit, or guaranteed maturity benefits plus accrued guaranteed additions, whichever is higher. Also, note here that all other policy benefits will be ceased on payment of death benefit.

Surrender Benefits

Policy Term 10 Years- Acquire Surrender value after 3-year full payment

Premium Payment Term 7 Years- Acquire Surrender value after 2-year full payment

The surrender value is calculated as-

Guaranteed Surrender Value + Value of Accrued Guaranteed Additions & Special Surrender Value

FAQ’s

What if one stops paying a premium?

If the premium is not paid within 30 days of the due date the policy will lapse. ICICI Pru Guaranteed Savings Insurance Plan can be revived within 2 years of the first unpaid premium. And, if after acquiring surrender value the premium is discontinued then the policy status will be changed to “paid-up”.

How can I surrender the policy?

The surrender value will be acquired after 3 years of the policy. Surrender Value is calculated as-

Guaranteed Surrender Value (GSV) +surrender value of accrued GA’s

Can I get a loan against ICICI PRU Assured Savings Insurance Plan?

Yes, the loan facility is available under this plan.